WT$ Is Streaming Economics

WT$ is streaming economics?!?

These are the words a recording artist and friend texted me recently.

It's a great question (and headline).

Streaming models and content economics are among my bread and butter.

Now let's take a stab at both and simplify it all.

And I promise – little-to-no 'inside baseball' jargon in this one.

Misunderstood

By exploring a bite-sized, conceptual understanding of streaming economics we can explain why it is continually being misunderstood – even by industry experts.

We can also inform what actions to take as artists, partners and industry folk as we understand it a little bit better.

The statement to burn into the back of your mind is the following:

Unlike traditional, physical and digital download eras, streaming payouts are calculated based on ebb and flow economics (aka constantly fluctuating factors).

That is why the debate is complex, often misconstrued and should not be measured by a static one-dimensional indicator such as – 'what is the industry/platform/market per play rate?'

Bare with me.

The 'Fluctuating' Parts

There is a constant ebb and flow to

- how streamed music is listened to by audiences

- how platforms generate revenues in different countries, and

- how platforms' various "bells and whistles" are applied to calculate it all

Let's focus on the first two of these factors.

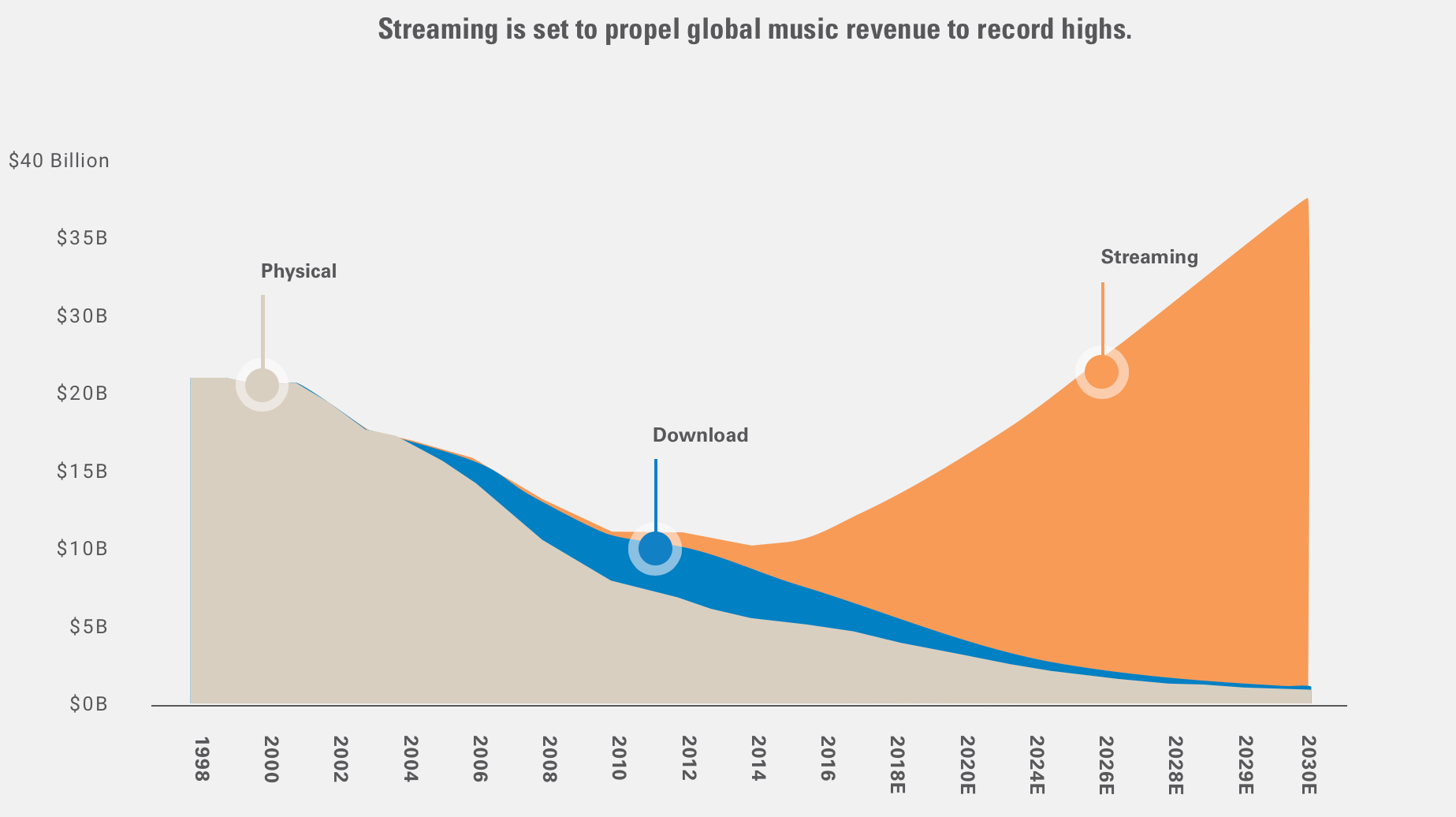

Monolith

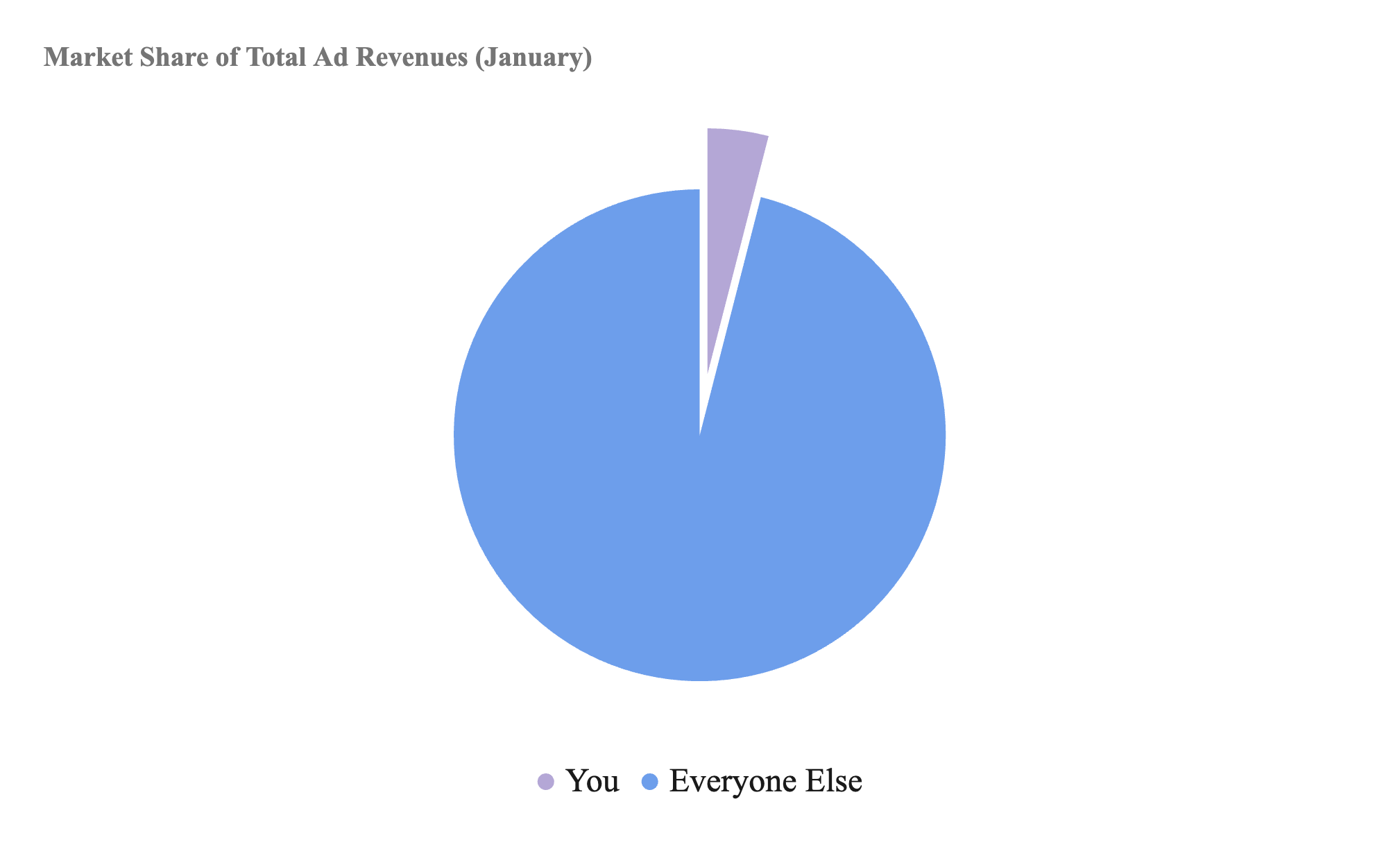

As streaming continues to be the monetary monolith of music (see below), while showing signs of innovation (new business models), we are presented with the need to understand its fundamentals.

What I'd like for you to walk away with is conditioning yourself into thinking and applying this ebb and flow concept across the business. Foundational incentives change with new models, however the ebb and flow nature of streaming economics will remain.

Seasonality

Your sense of cyclical or seasonal, in how you craft music and release it, should also be applied to your holistic business thinking. Ask yourself:

- What happens when there is an up-turn (in growing number of listeners, platform-wide new releases)?

- What happens when there is a down-turn (in platform-wide revenues and new releases)?

Let's set fragmentation and the current broken model of pro-rata aside.

Let's dive into an ebb and flow example.

This is what had happened to my artist friend earlier this year (hence the great question/headline).

A Fish In A Pond

To showcase the concept I'm going to illustrate:

- the nature of advertising seasonality

- tie it to the release of a record, and

- how the above factors could impact streaming payouts

At the start of every year, there is a seasonal reset in the advertising industry. Meaning in January of every year (and a good portion of Q1), industry wide advertising sales and revenues see a natural softening or down turn after the aggressive ad sales push of the previous end-of-year holiday quarter.

So how does this relate to an artist releasing a record or to streaming payouts?

Because most platforms have an advertising tier of service (ie their 'free' listening experience) and their payouts are generally tied to ad market seasonality.

So now back to ebb and flow!

Small Fish, Big Pond

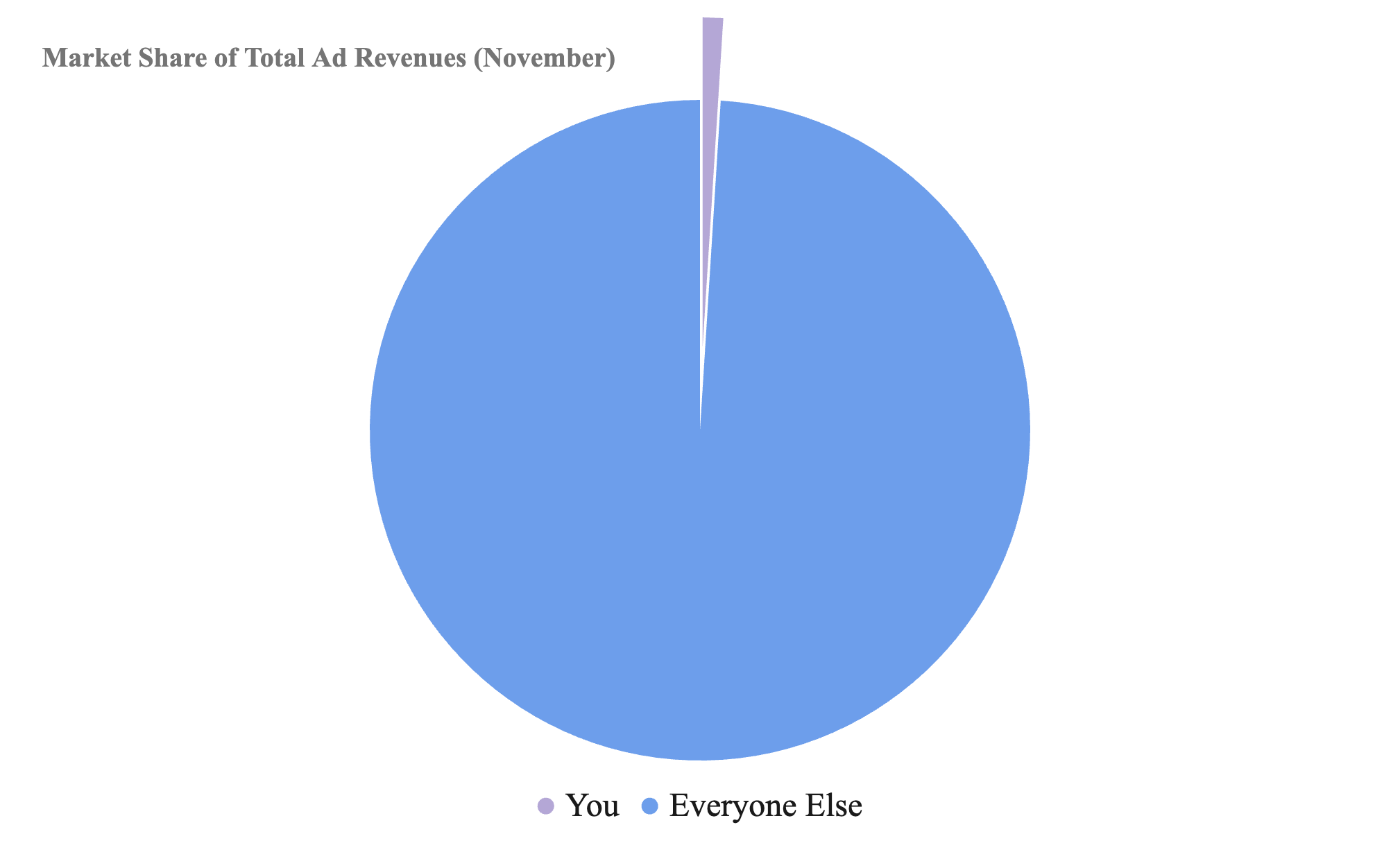

You release a new record in November where:

- platform advertising revenues are at an annual high (larger $ pie)

- there are significant new releases from global artists this time of year (it's very crowded, difficult for you to gain market share)

- you market your new record (resulting in strong play count performance)

Result:

- there is a 'bigger pie' of platform money that month to be shared (ie Big Pond)

- there is a 'ballooned' competitive landscape of other new releases (other artists competing with you for a share of plays)

- you garner a marginal market share from strong play count performance against the 'ballooned' landscape (ie Small Fish)

- your payout is also smaller (ie Small Fish)

What happened?

Even though there was more money to share with all artists, you were ultimately dwarfed by others' performance.

Big Fish, Small Pond

Now you release a follow-up record in January where:

- platform advertising revenues significantly soften in January (much smaller $ pie)

- there are less-than-usual new releases from global artists this time of year (its less crowded)

- you market your new record significantly more than your last (more plays, more market share)

Result:

- You garner more plays, more market share for this release than the last (ie Big Fish)

- However you end up making less money than the last.

What happened???

Even though there were less releases to compete with your higher volume of plays, there was much less money to be shared with all artists.

How could this be right?

The fluidity and fluctuating factors were not in your favor. Even though you garnered more plays, and there were less releases on said platform – the ad revenues ebbed to a lower amount as a whole (as seasonaly expected).

Is this wrong? Arguably no its not, but it is an issue of the core principles of the pro-rata model. All or nothing via market share dynamics.

And for those experts trying to squeeze an 'economic equilibrium' out of music streaming – this is one of many reasons why the pro-rata model has been outgrown for use for many years (initially the pond was much smaller, beneficial for those early swimmers).

That said – what to action? How to action?

The Answer

Identify your ebb and flow and where most of your money is coming from streaming.

- Identify where most of your streaming payouts come from (platform wise).

- Then identify if most of that platform's payouts are coming from ad served or subscriber based listeners (your distributor reports should indicate this).

- If most of your money is coming a platform's advertising served listeners – you now know to consider the fluidity of streaming and advertising seasonality when releasing new music.

My personal recommendation to this artist was two fold.

- Being knowledgeable of the above, and

- Begin taking ownership of their fans within their greater audience across platforms.

Reaching and moving their most ardent fans to platforms where they are able to directly contribute to the artist isn't an escape from these other platforms but a means to expand the funnel of where your audience lives, listens and eventually thrives (ie generates your livelihood).

The above had turned this artist's payouts around, as well as reduced their susceptibility to shifts in streaming dynamics.

Bigger Takeaway: Lifers

Economists are lifer strategists. We think long-term. And so do artists and their teams.

Your musical world building is life-long and long-term.

Focus on what you can control.

Learn to weather the ebb and flow of your business, your creation and learn to insulate yourself from outdated systems, models and avoidable events.

The human instinct for self-preservation is high these days. As is the need for education.

Lean in where you can, share experienced knowledge (like this piece). That's how we de-mystify the industry.

There is no shortage of mystification and debate in music today (streaming models, fraud, generative AI, list goes on).

Let's keep shifting doubt and debate into action.